Miami Beach has been proactive through planning and projects to reduce the risk of flooding; however, our geographic location and elevation makes Miami Beach vulnerable to storms and sea level rise.

Under the current FEMA Maps, 93% of all buildings are in the Special Flood Hazard Area, requiring flood insurance for federally backed mortgages and recommended for all properties.

The City works to reduce flood risk on many fronts. This includes a mature dune system to reduce the impact of storm surge and erosion, a comprehensive stormwater management program, elevating low-lying streets, a Resilience Code to address current and future flood risk for development and construction, higher seawall elevation, and private property assessments in tandem with a competitive flood risk mitigation grant program.

Flood insurance can help you rebuild your home faster and stronger. For more information on flood risk and flood insurance:

Miami Beach Saves You Money on Flood Insurance

Miami Beach has also been able to increase flood insurance premium savings citywide. The Community Rating System (CRS) of the National Flood Insurance Program (NFIP), is a voluntary program allowing communities to earn flood insurance discounts based on the City’s overall rating score and property characteristics.

Miami Beach’s participation in the Community Rating System provides most NFIP policy holders a 25% discount. This helps offset increasing federal rates.

Watch Mayor Meiner's Forum on Flood Insurance and Risk Reduction

Mayor Meiner and the Program for Public Information Committee held a public forum on April 8, 2024, to discuss flood insurance and risk reduction.

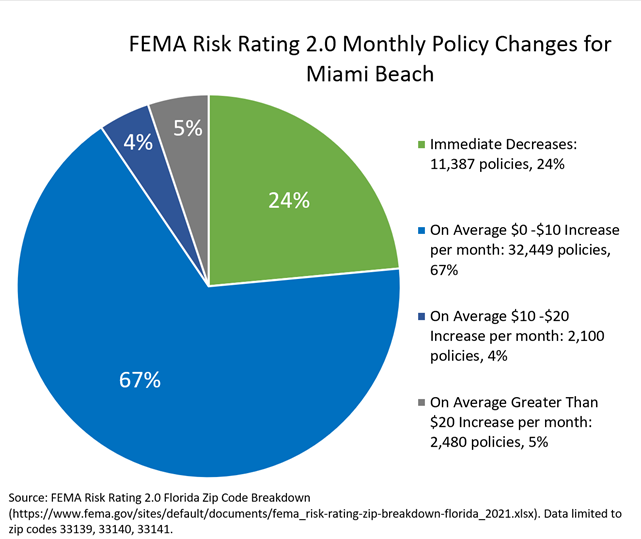

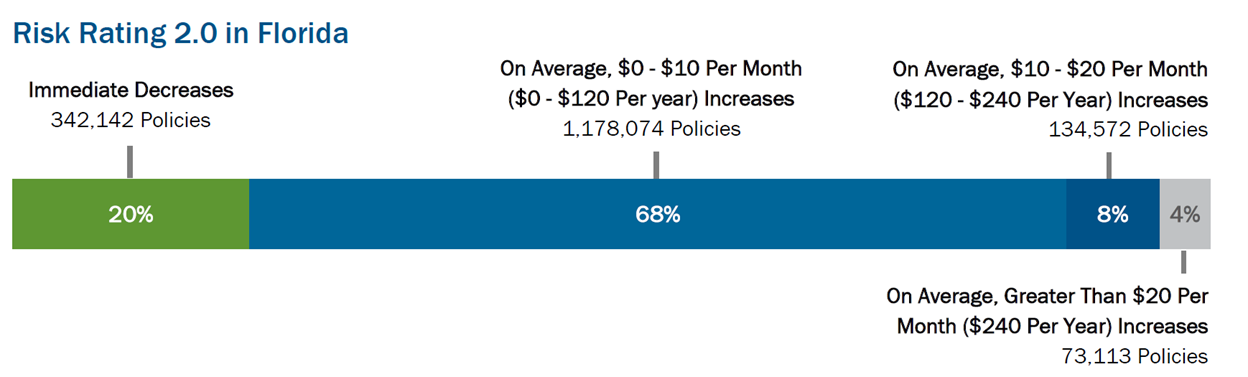

Risk Rating 2.0

FEMA is changing how the National Flood Insurance Program prices the cost of flood insurance through a process called Risk Rating 2.0. Policy holders are encouraged to contact their flood insurance agent to understand how the new pricing approach may affect them.

As of August 1, 2021, current National Flood Insurance Program policyholders are encouraged to contact their insurance company or insurance agent to learn more.

83°

83°